With roots in proprietary trading and low-latency order management, the 20C team was tasked with creating a solution for algorithmic trading firms attempting to manage high frequency trading systems using legacy trading platforms.

Five core issues needed to be resolved:

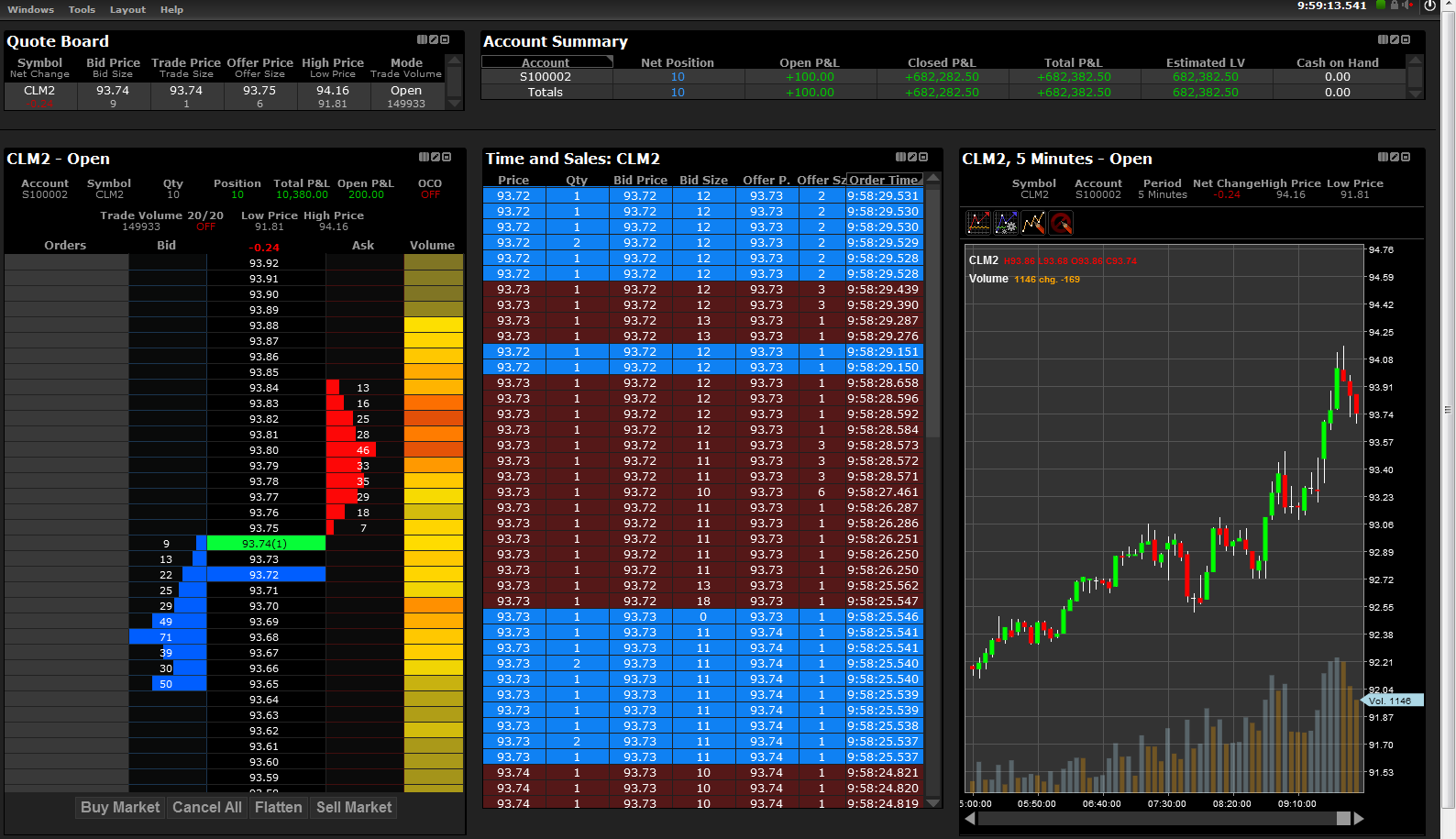

Eliminate Buffers

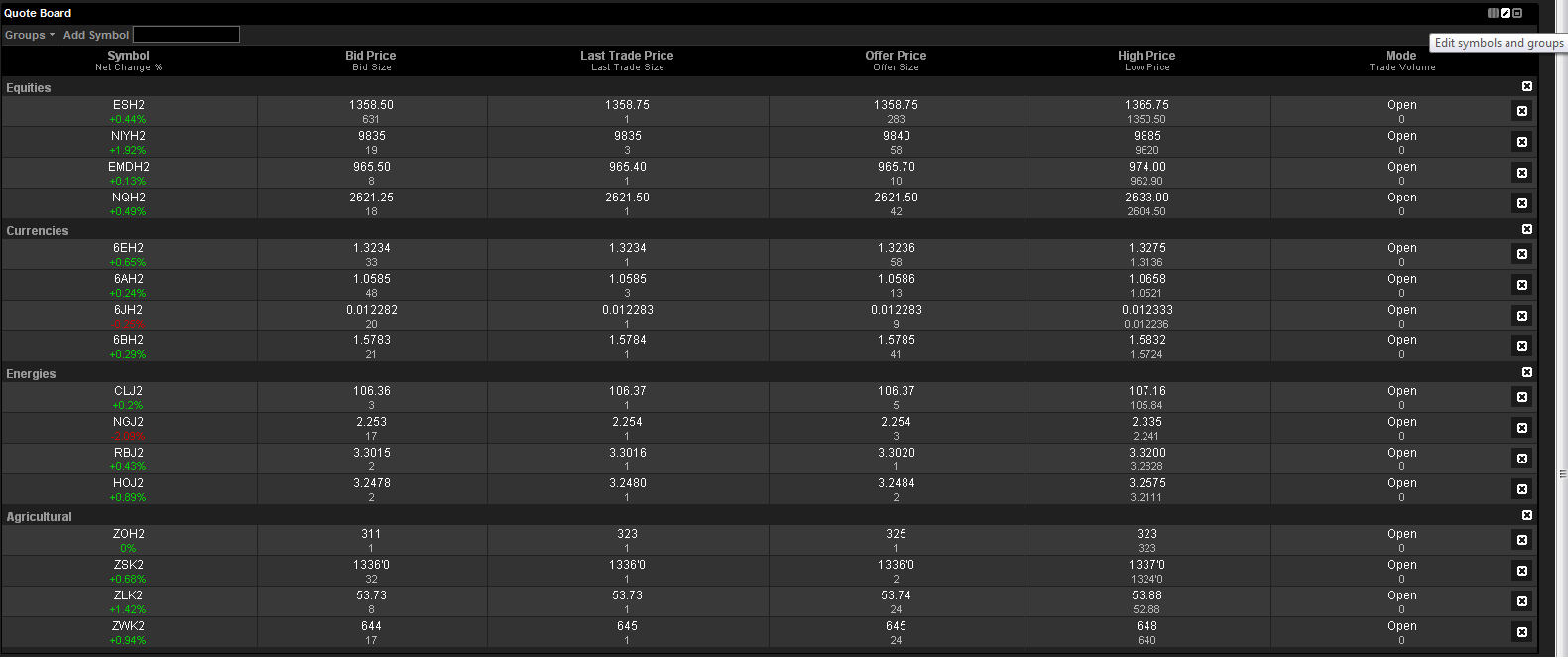

It is not necessary to slow down, aggregate, filter or otherwise modify the data to avoid the dreaded 'buffering affect' caused by most trading platforms. Even as the amount of market data has increased exponentially, trading engines have found methods to process all the data while traditional platforms remain the bottleneck. 20C eliminated the buffer during the most demanding and volatile periods quickly becoming the preferred order management tool of all the proprietary traders.

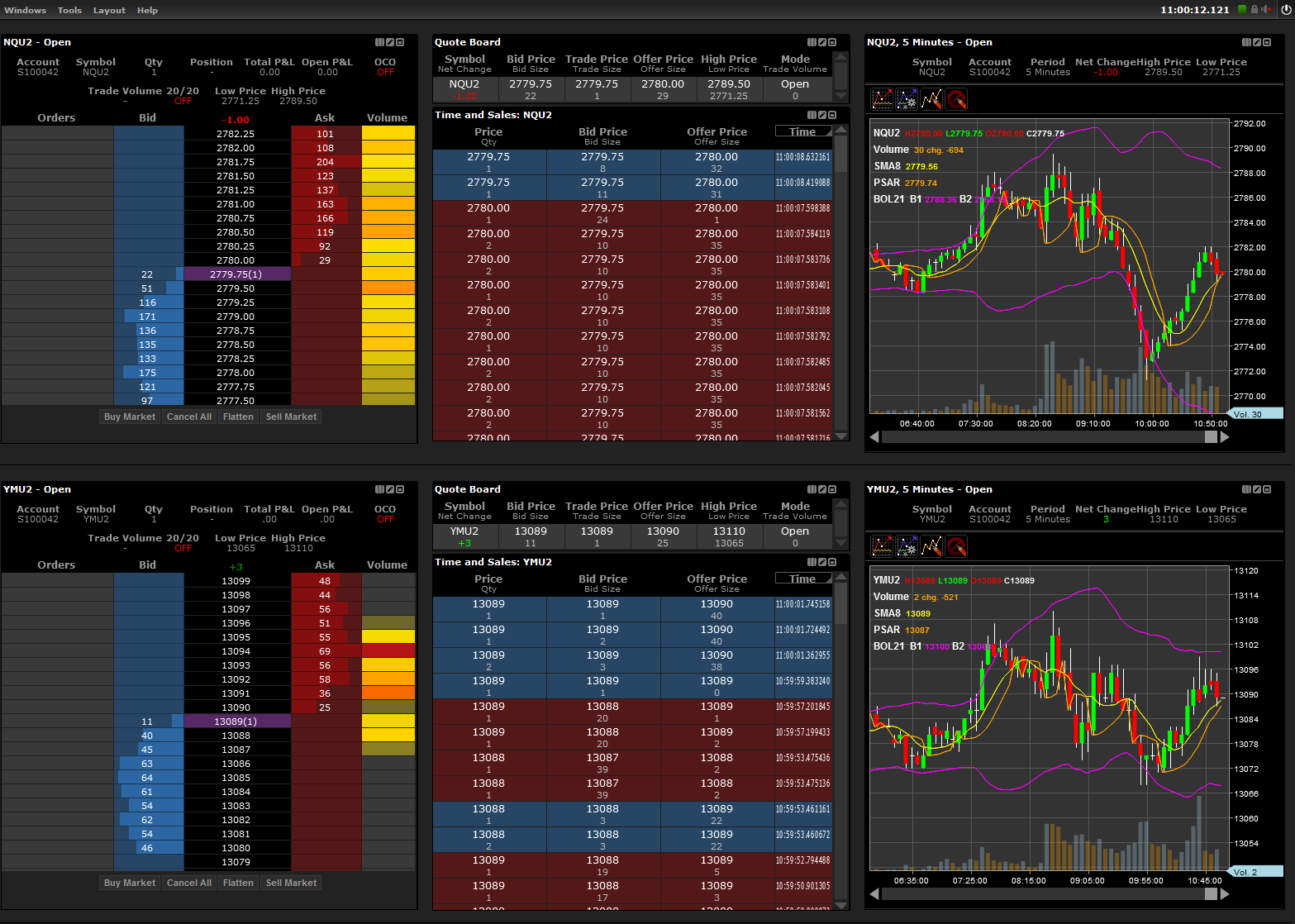

Remove Desktop Risk

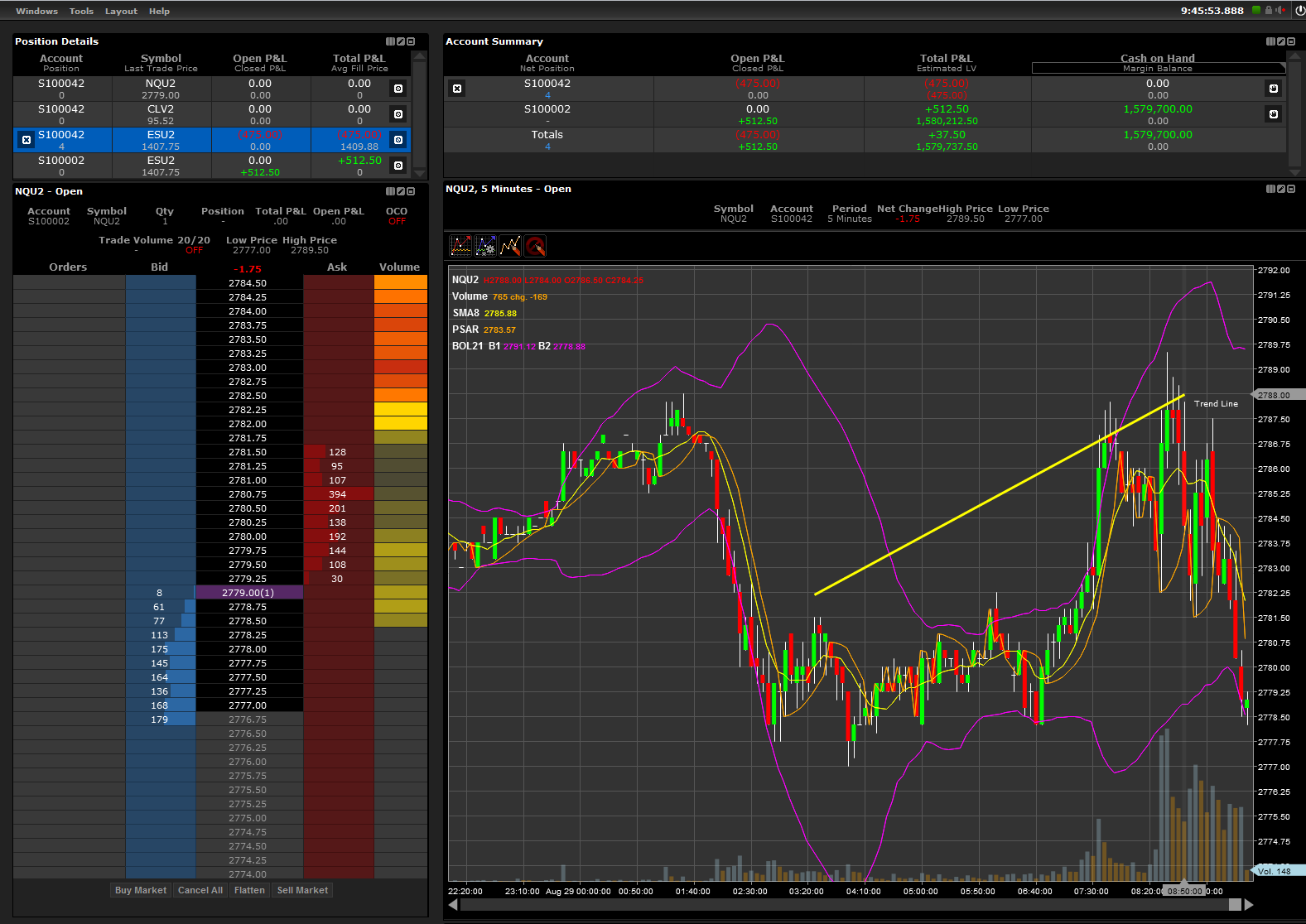

OCO's, brackets and other synthetic order types cannot be managed by software running on the trader's desktop nor can other advanced order routing instructions. Both speed and reliability are dramatically increased by moving the processes that manage the orders off the desktop and onto the server. 20C pushed all order instructions server-side with an easy to manage interface.

Eradicate Version Risk

Far too often platforms make updates, fix known bugs or bring their software back into compliance by releasing an 'update.' Traders must try and stay on the latest version and waste valuable time downloading, updating and restoring their workspaces or risk using the quietly unsupported version. 20C implemented server-side version control with quick and easy roll-out and roll-back functionality.

Flawless Trading Engine Integration

While it is imperative to have an abundance of input from traders and trading professionals, it is equally imperative to have the design and integration performed by professional programmers and engineers. Traders trade. Programmers program. 20C analyzes trading engine solutions and works directly with the developers to ensure the most efficient integration possible.

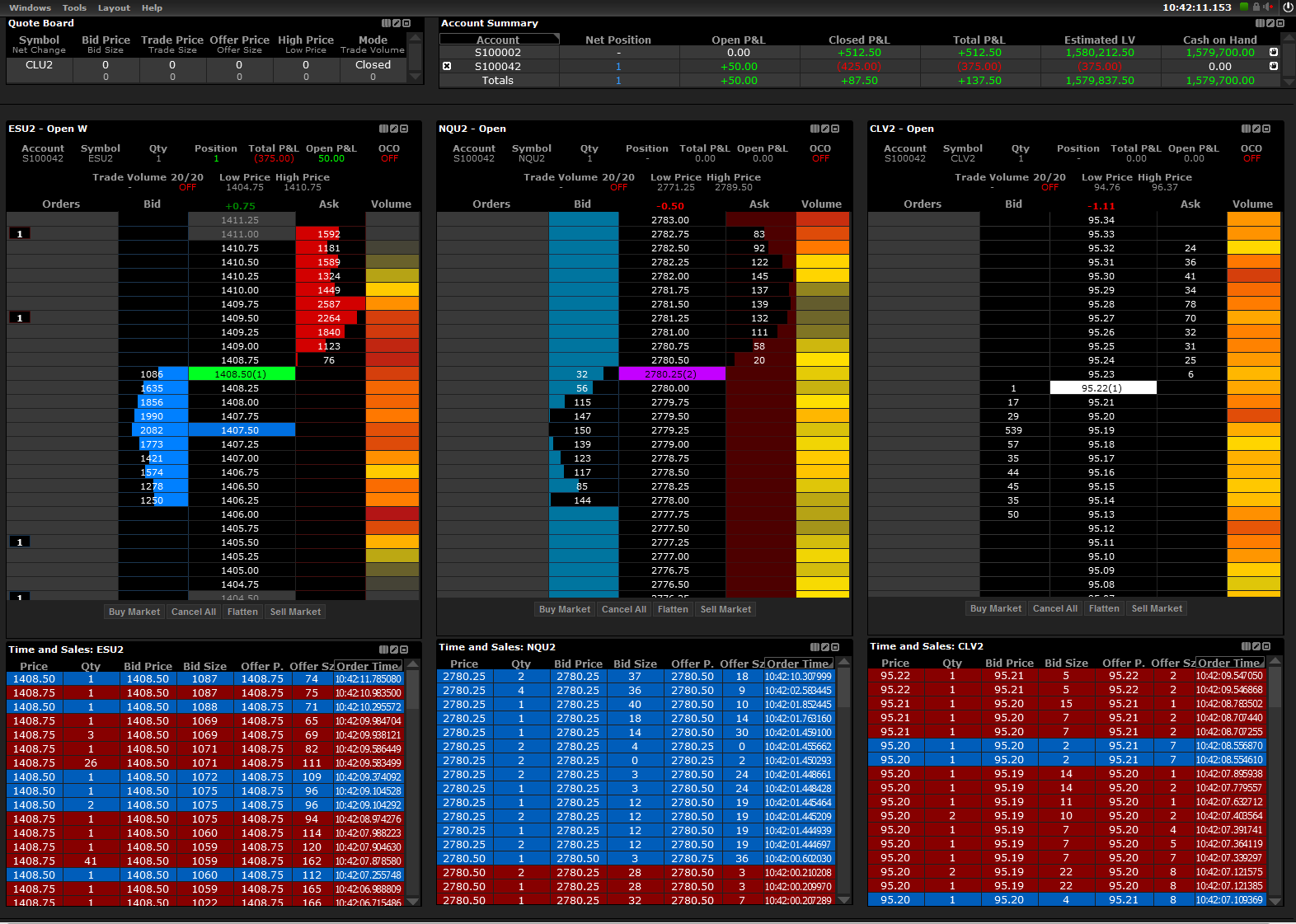

Innovative and Customized Synthetic Order Types

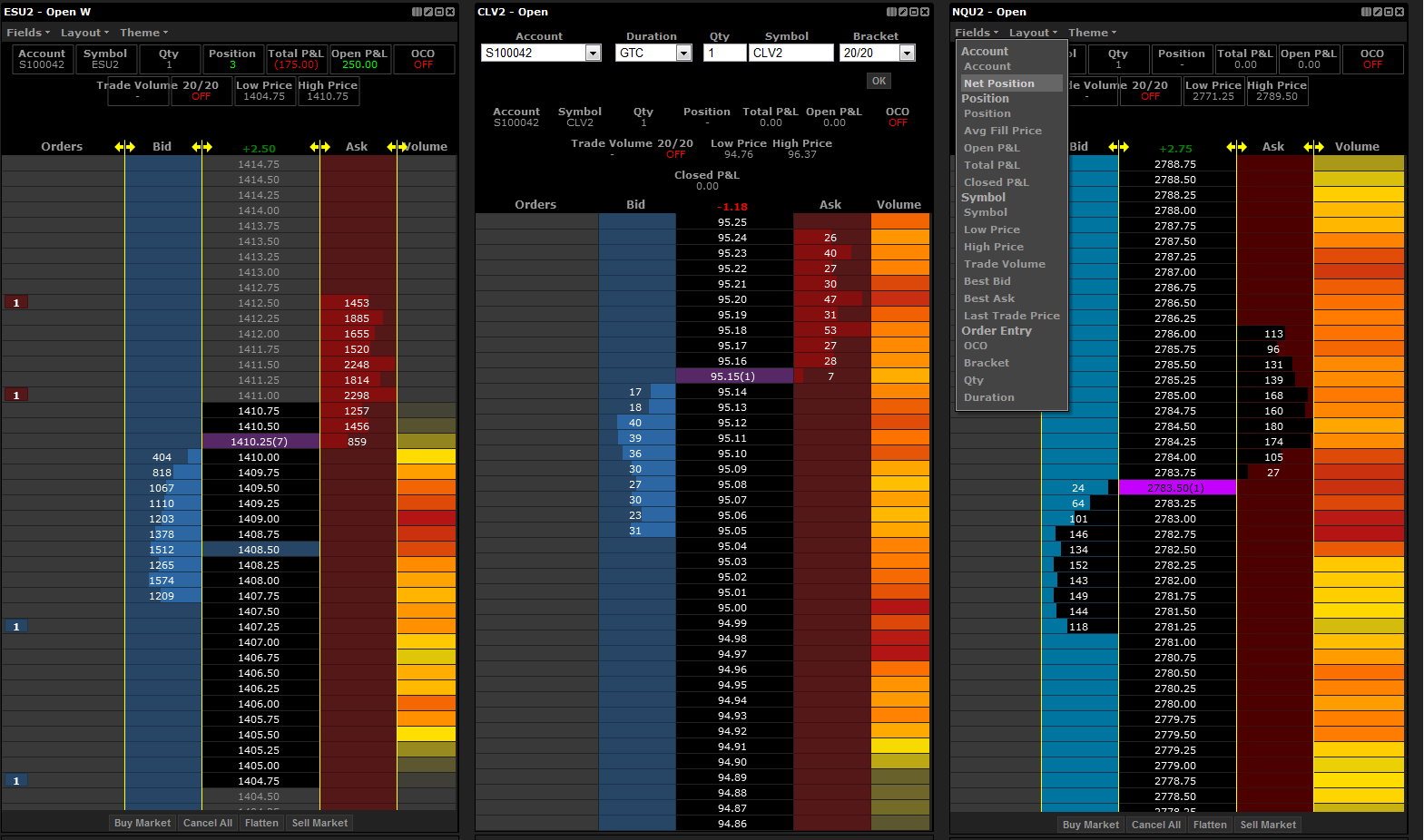

New and innovative order types were needed to maximize the return of trading systems. Each order type needed to be customized to the style of trading being implemented. The 20C developers customized order entry options to allow the traders to define their own synthetic orders while retaining their presence server-side.

With the successful implementation of the customized algorithmic trade management platforms, focus shifted to creating a modified version of the software that all traders could use. Additional tools were added to accommodate remote connectivity, latency monitoring and server-side simulation trading. The end result is an evolving trading software tool known simply as 20C Trading Cards™.